Freight Factoring

Made Easy

Get Paid Faster

Get your invoices paid within hours (or minutes) with Flexent’s Real Time Payments and fuel cards.

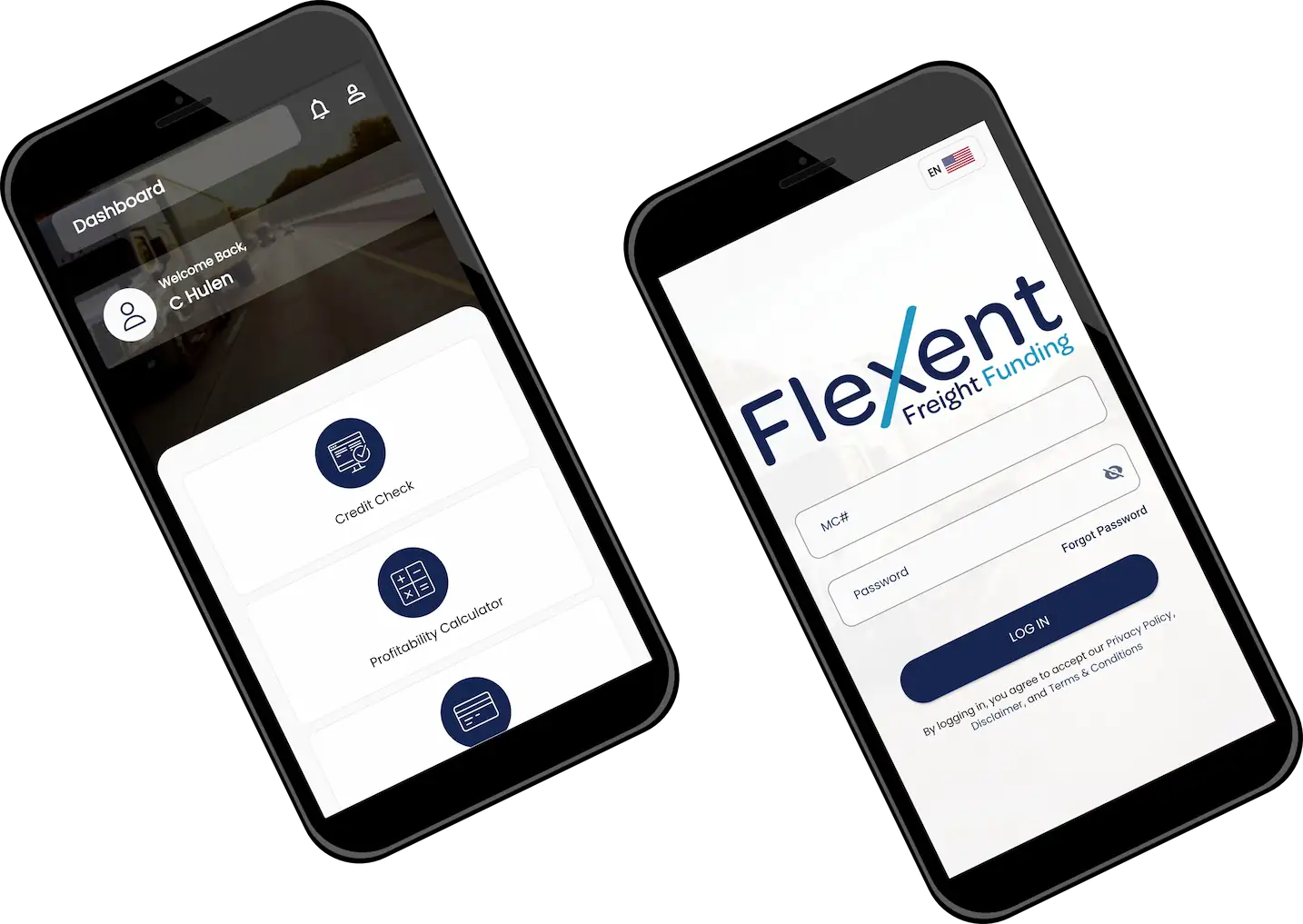

Access Anywhere

Check broker credit 24/7, upload paperwork, and access load boards all from our mobile app.

Bank Level Security

We are owned by a 120-year-old bank, and have strong security systems to protect your data.

Cut out the wait.

Get paid in hours.

Get started

Free Quote

What is

Freight

Factoring?

Freight factoring is a form of financing designed for truckers.

With freight factoring you don’t have to wait 30 or 45 days for brokers to pay. With Flexent, you can get paid same day.

Complete Delivery

Work with brokers (or direct haul) and deliver your load as usual.

Upload Paperwork

Take a picture or upload your paperwork through our mobile app.

Get Paid Same Day

Don’t wait 30 or 45 days. Get paid in hours…or minutes!

Flexent

Fuel Cards

Why Flexent?

Real Time Payments

With Real Time Payments you can get paid directly into your bank account within minutes of your load paperwork being reviewed.

Bank owned

Being bank owned means we are held to higher standards compared to our competitors. That means more security for you.

Personal Service

We are here to help you succeed. You can always pick up the phone and speak to a person.